HMO KICK-START ACADEMY

YOUR HMO JOURNEY STARTS TODAY!!!

Next Start Date: October 1st 2024

KICK-START YOUR PROPERTY JOURNEY WITH THE HMO KICK-START ACADEMY 8-WEEK HANDS-ON COURSE DESIGNED TO GIVE YOU ALL THE TOOLS YOU NEED TO BECOME A NEXT-LEVEL LANDLORD!

Do you find yourself wondering if property investment is really possible for you? It's natural to have these concerns, but they don't have to be roadblocks.

Think of it this way: what if these perceived barriers are just background noise? What if you had expert guidance to help you tune it out and focus on what really matters? That's where our HMO Kick-Start Academy comes in.

Join us for an 8-week programme where you'll learn to navigate the property market with confidence. We'll assist you in honing in on the right location, building a pipeline of potential HMOs, navigating legislation, managing agents and most importantly getting you your first deal!

Meet Matt Baker

Matt is a renowned HMO education leader and property investor, co-founding the award-winning Scott Baker Properties and The HMO Platform. His journey from struggling musician to successful investor is inspiring.

He authored the best-selling "Next Level Landlord," hosts the top-rated "Property Jam Podcast," and champions accessible UK property investment. Starting in 2015, Matt's customer-first strategy rapidly built a £5 million portfolio, revolutionizing HMO investment.

His Tenant First Method, requiring little personal capital, has guided hundreds in their property journey. Join Matt to transform your future in property investing.

Say Goodbye to Mentorship That Vanishes Post-Signup:

We're Different: We learnt how to do it right!

Tired of being left in the lurch after the initial spark?

Our mentors stay by your side.

End the Post-Seminar Struggle:

No more confusion on where to start when reality kicks in—we're your Monday morning strategy.

Escape the Novice Trap:

Frustrated with under-qualified guidance? Our experienced mentors have a proven track record.

Break Free from Quick Fixes:

Move past the temporary solutions and embrace a long-term, sustainable growth plan.

Forget one-size-fits-all advice.

Our personalised support is tailored to your unique journey.

Start Supported, Stay Strong:

Begin your property journey with the right tools and continuous hands-on guidance.

Beyond Improvisation:

Leave the make-do methods behind and advance with our structured tools and systems.

Ditch Solo Learning:

Don't go it alone—our resources and community are with you at every step.

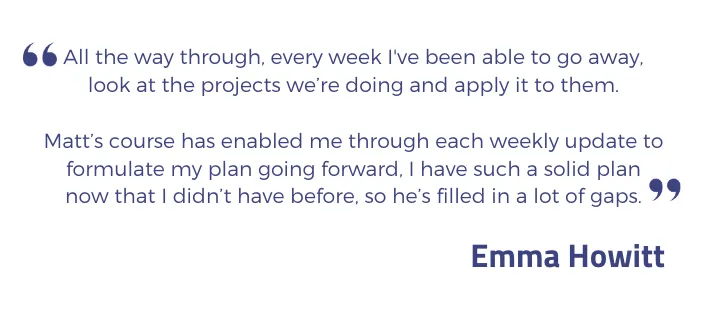

What Our Students Say

We have learnt from our students what good looks like and thats why we aim for exceptional.

Next Start Date: October 1st 2024

Costing: £2,499 +VAT

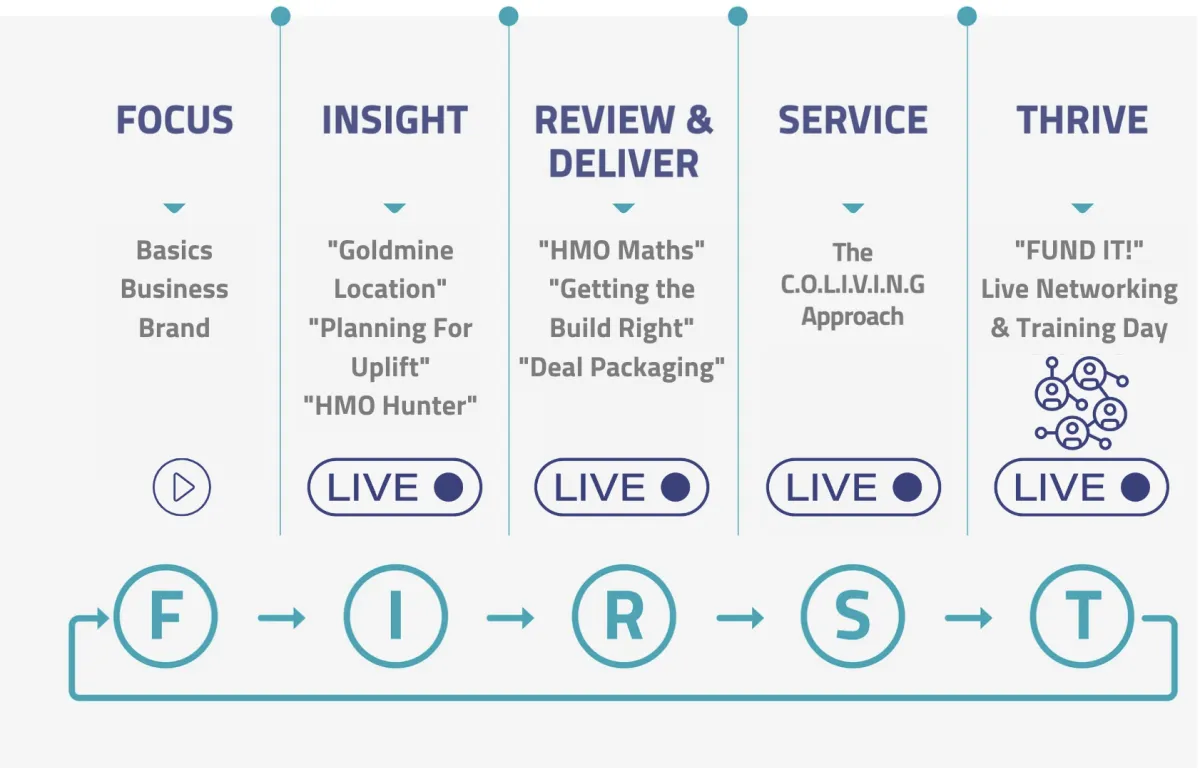

8 Modules, 8 Weeks, Your First (or next!) Deal

The HMO Kick-Start Academy Has 3 Parts

All Focusing On The Outcome

The Tenant FIRST Method

A proven methodology created off the back of Matt's No1 Best Seller, Next Level Landlord "The Tenant FIRST Method" is responsible for over £25m in client project deals over the last 3 years so we know it works.

We break it down for you over a series of 8 live and interactive workshops and additional online videos that will lead you to one or more high cash-flowing HMOs!

In-person "Fund It!" Networking and Training Day

Step away from the screen and into the real world with our in-person "Fund It!" day in Guildford. Join us for an intensive, action-focused Mastermind and networking session that spans an entire day. This immersive experience is designed to equip you with practical strategies and clear actions. By the end of the session, you'll have a personalised action plan that bridges the gap between where you are now and your next significant achievement, your first HMO!

Daily Support in the HMO Kick-Start Academy Facebook Community

Our Academy's community is at the heart of what we do and a place where seasoned investors and fresh faces collaborate with no bias. It’s a space dedicated to ensuring your deals make financial sense, fostering partnerships that work, and celebrating successes together. Here, we're all about making sure every member thrives, every question leads to knowledge, and every deal stacks!

Over £10,000 worth of education for £2,499+VAT

Next Start Date: Monday 15th April, 2024

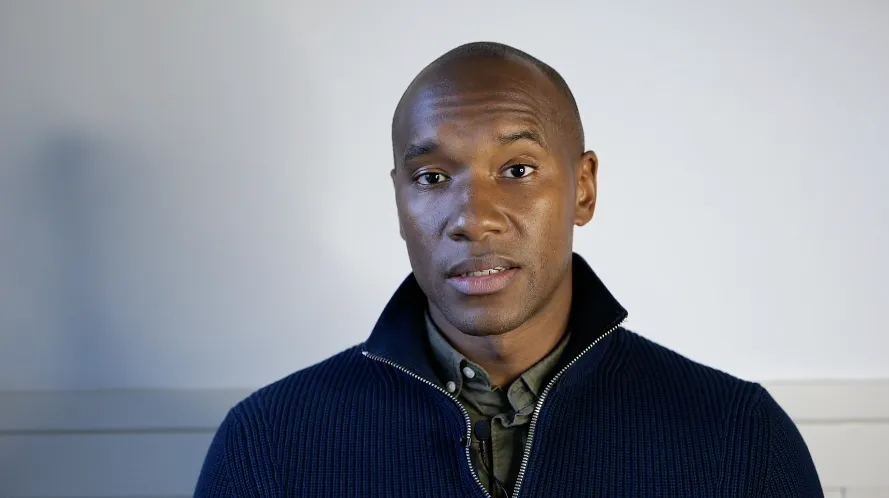

The 8-Week HMO Kick-Start Academy

8 Modules to Your First Deal

Session One:

'Goldmine Location' - Select your Prime Investment Location

Session Two:

'Planning For Uplift' - Navigate through Planning Permissions to create £100k+ equity

Session Three:

'HMO Hunter' - sharpen your skills at lead and vendor negotiations

Session Four:

'HMO Maths' - Understand valuations, cashflow and getting your all-important return on cash

Session Five:

'Getting the Build Right' - Calculate build cost and find the right team

Session Six:

"Deal Clinic' - bring your deals and get Matt's view on them - this is where you get the sense check and 'ok' to do deals!

Session Seven:

'The COLIVING Approach', exploring how we provide the high-level service to create your coliving community

Session Eight:

'Fund It!' Day - Join us for an in-person day to get you investable to raise 6-figures

£100k in 100 Days

Gain the insider knowledge to raise £100k in 100 days with our comprehensive system, perfectly suited for investors at all levels seeking private finance. This pivotal resource, valued at £1,499, seamlessly integrates into our course, ensuring you have the tools to thrive in property investment without any extra investment. Enrol now and unlock the potential to propel your financial success in the property market

Worth £1,499+VAT

Deal Stackers, Legal and Finance Templates & Agreements

Elevate your property investment game with our comprehensive Deal Stackers, Legal, and Finance Templates & Agreements pack, valued at £499. This indispensable toolkit is designed to streamline your investment process, ensuring you're equipped with professional, legally-sound, and financially savvy documents. Save time, reduce errors, and foster confidence with templates and agreements.

£499 value

Our Network is your Network

As Simon Sinek says 'The true value of networking doesn't come from how many people we can meet but rather how many people we can introduce to others. This is a philosophy we stand by and by joining the Kick Starter Academy you will get access to our extensive network of investors students deal sourcers and our privite social groups and events.

£ Priceless

Bonuses: Included in Your £2,499 +VAT Investment

Property Filter for Two Months - On us!

By extending your Property Filter membership for an additional eight weeks at no extra cost, you gain even more value from this market-leading software. This complimentary extension, worth £240, offers a significant opportunity to enhance your property sourcing strategy. With continued access to a vast array of property listings and sophisticated tools, you can more effectively identify and capitalise on profitable opportunities. By giving you an extra month allows for deeper market exploration and the potential to secure better deals, directly translating into a tangible ROI. It's an invaluable offer for anyone serious about maximising their success in the property market.

Done For You Sourcing

When you unearth a lucrative deal, but don't want to handle it yourself, we've got you covered. Our dedicated team can source it for you, with absolutely no fee involved on your first deal. That's right, zero fees! This isn't just about convenience – it's about saving you thousands in compliance and legal documentation costs.

And here's the kicker: when you find that golden opportunity through the Kick-Start Academy, you pocket the entire sourcing fee, ranging from £5,000 to £15,000, all for yourself. Don't miss out on this incredible chance to turbocharge your investments and reap the rewards! Join us today and unlock your financial potential.

Our Success is our Students Success!

Case Study: Michal K

Michal came to us with a small portfolio of HMOs and was looking to scale up, and scale up he did! Over the course of his year with us, he purchased 13 properties - some HMOs with potential and some to develop. These projects created a life-changing £13,000 profit per month of income!

Case Study: Tej

Tej, a pharmacist, works alongside his mum and together they have secured 4 deals in one year following the methods we prescribe. He is already profiting over £3000 per month and is about to quit is job.

Case Study: David & Julie Anderson

Julie and her son, David, had very little property experience prior to starting with The HMO Platform. But they were raring to go - securing two 13-bed HMO properties in their first year with us. One of these was an existing cashflowing HMO with future potential. The income they got straight away meant that David was able to stop working his day job and focus on growing their portfolio.

HMO KICK-START ACADEMY FAQS

How long will the HMO Kick-Start Academy take me?

It’s going to take you a few hours a week to get started but, but when you have your properties up and running following the Tenant FIRST Method, then you will hardly hear from your tenants and it will only take you a few hours a month to manage.

It’s important to set up your business according to a proven system will save your time, money and sanity in the long run!

Can I invest in HMOs if I work full-time?

Yes.

Most people start investing in property and HMOs whilst working full time. If you create protected time for your property investing every week and stick to it, then your success is inevitable. The initial work is up-front, but as you get going the deals will start to come to you – remember this is something ‘you want to do’ so finding the time shouldn’t be that hard!

As you get your first HMO properties online, and build up your cashflow, this will give you the choice of whether to work or not, and that’s when you will know it was worth the time you found at the beginning to make it a reality.

How long will it take me to get my first deal?

When you follow our Method, you’ll be offering on properties within weeks. Most people get their first deal within 3 months, but others have even got their first deal in their first month of working with us.

In fact, we will guarantee that if you follow our method and you don't have an offer accepted within 8 weeks, then we will refund the cost of the programme in full.

How much money do I need to start in HMOs?

You don’t need to have the money. I started with no capital and £50k worth of debt and still made it happen by attracting joint venture partners and angel investors.

In the Programme and in particular the Live In-Person "Fund It!" Networking and Training Day, we walk you step by step through how you can become investable and how you can even secure a property without paying for it now.

Should I set up my business before joining the HMO Kick-Start Academy?

When you start the Kick-Start Academy, we will guide you to the right part of our team to help you set up your HMO business correctly for your circumstances. For some it will be simple, for others it will be more complicated, but we won’t know that until you start.

It is important to get your structure correct before you buy your HMO, so there is no need to set it up prior to starting the programme.

Can I buy HMO properties if I have bad credit?

If you have bad credit, then this dramatically reduces your access to bank funding. However, some of the most successful entrepreneurs started off with poor credit or significantly in debt.

When I started, I has almost £50k worth of credit cards and loans, and I still managed to make it work. If this is you, then, depending on your circumstances, your first few deals may be difficult, but not impossible.

If this is you, then when you start, we will give you specific guidance as how to manoeuvre through the first 1-2 years of property investing. HMOs are fantastic way to start in business and to make positive changes in your life.

Is now the right time to buy HMO properties in an uncertain market?

The Royal Institute of Chartered Surveyors shows that in recession residential rental demand increases. The number of rental properties in the UK is decreasing – some stats say up to 66 homes a day are being lost! This means that rental demand is increasing dramatically.

If we go into a recession or find ourselves in one for an extended period, then rental demand will increase and rents will going up. It also means that the price to buy properties for conversion will come down.

These are the 2 factors alone mean that now is probably the best time in recent history to create HMOs.

What about high utility bills?

High utility bills are one of the biggest potential variables within our business, so must be managed well. We can’t control the price of energy, but we will show you a number of ways to reduce the amount of energy used in a property.

We are advocates of improving the energy efficiency of the properties that we develop, so we will show you the methods that work to do this to reduce the amount of energy a property requires. We will also share our methods to have greater control over the amount of energy that tenants use.

But we can’t control 100%, so we will share the failsafes that we use to ensure that tenants can’t use unlimited amounts of energy with no consequences.

And right now there is more opportunity than ever.

What if I can’t find tenants?

This is a concern that we often get asked about. However, it is one that is easy to overcome.

If you follow the method that we lay out, you will be buying and developing properties that people will be clamouring to rent. Not to mention that rental demand is at all-time high at the moment, so there are multiple applicants per room in the locations where we and our clients are investing throughout the UK.

Within the Programme, we explain exactly how to choose the right property in the right area and price it correctly for your target housemates. If you do the work right up front then you will have no issues finding good quality, high value tenants.

Does the HMO Kick-Start Academy cover other strategies, like serviced accommodation or Supported Living?

No.

The HMO Kick-Start Academy only covers the creation of HMOs using the strategy of good quality, high-spec properties.

This doesn’t mean that we don’t know about those strategies, so some of our clients find good properties where these strategies may work, so we are able to guide them to do those deals. However, we recommend that you focus on one strategy at a time, master it and then move onto the next.

HMOs seem too hard, aren’t buy-to-let houses and flats easier?

Yes, buy-to-let flats and houses are easier, BUT you have to buy a lot of them for any impact on your bank balance. Especially with high interest rates and strict affordability criteria, most mortgages are capped at lower loan-to-values, so you will leave more money in each property lowering your return on investment and your ability to recycle your money into multiple properties.

If you do well, you might get £100 per month on a buy-to-let – we would expect to make £800-£2000 per HMO property depending on its size.

You also have to be very careful with flats, because the service charges can be unpredictable and can go up dramatically without much warning.

If you are considering a new-build property for this purpose, then also be very aware that they are statistically less likely to increase in value over the short term, so they could create a future problem for you when you come to refinance and the property isn’t as valuable as you thought.

I want to buy properties but can’t afford it, is doing HMOs right for me?

If you are looking to buy properties to create an income as quickly as possible, then investing in HMOs is a great way to speed up your ability to have more income. I started with 1 buy-to-let bungalow and quickly saw how long it was going to take me to create the income I wanted. So I quickly agreed to buy a house that became a 5-bed HMO, then went on to build a portfolio of over 100 rooms worth almost £5million in 4 years.

Since then, we have developed commercial properties into HMOs and mixed-use buildings and are now building houses and creating value through planning permissions. We’ll show you how you can do the same.

Creative purchasing methods and creative finance means that you don’t necessarily have to have a lot of money to start. We have also raised over £5million in investor and Joint Venture finance; in the HMO Kick-Start Academy, we will show you how you can do this too and how to structure it to keep yourself safe.

This is why the time is NOW to be investing in HMOs.

What is the Money-Back Guarantee?

We are confident in our methods and that they can work for you if implemented - so we offer a money-back guarantee!

If you follow our methods and you haven't had an offer accepted on a property within the 8 weeks, then we will refund the cost of the Programme in full.

For more information, check out our terms and conditions.